What is HDFC bank transaction limit per day?

HDFC Bank is the biggest and most trusted bank in India. Many individuals prefer HDFC bank for their service and security of their funds. With various saving account types, HDFC offers a maximum transfer limit per day through various transfer channels. In this guide, we will see what is HDFC bank transaction limit per day? We will also see how to increase transfer limit in HDFC bank account.

Before we see the transaction limits, let us know how to transfer the money online from your hdfc account.

Table of Contents

How to transfer money from HDFC bank account?

There are several ways to transfer money from your saving account –

- Through UPI – The most commonly used money transfer method nowadays. You can use HDFC bank app’s UPI feature, any third-party UPI app like PhonePe, GooglePay, or Paytm to transfer the money securely.

- Through NEFT – National Electronic Fund Transfer(NEFT) is the most trusted and safe money transfer that many people still prefer for a large amount. You can add a beneficiary using HDFC net banking, and after activation, you can easily transfer money anytime through net banking or mobile banking.

- Through IMPS – Immediately Payment System(IMPS) is used to transfer money in real-time. You have to add a beneficiary, and after activation, you can send money instantly.

- Through RTGS – For huge transfers, prefer RTGS as a payment transfer mode.

What is HDFC bank transaction limit per day? – hdfc transfer limit per day

We will see the transaction limit for various modes of payment done –

What is HDFC bank Transaction Limit per day for UPI payments?

Rs. 1 lakh per day. You can transfer 1 lakh per transaction within a day and do a total of 10 transactions in 1 day.

This limit is irrespective of which UPI app you use for patents. If you used PhonePe 2 times and HDFC Mobile banking UPI 4 times, then the total 6 times you used UPI, and only 4 are transactions remain for a day.

Fees and Charges – Nil

What is HDFC bank Transaction Limit per day for IMPS?

There are two methods of IMPS –

- IMPS using Account Number -Maximum limit per transaction – Rs 2 lakhs. Maximum amount in a day as per the TPT limits.

- IMPS using MMID – NetBanking and MobileBanking: Rs 5000 per day per Cust ID (on either of the channel). You can transfer Rs—5000 using mobile banking and Rs.5000 using net banking.

Fees and Charges – Nil

What is HDFC bank Transaction Limit per day for NEFT?

Rs. 2 Lakh per transaction. You can transfer Rs. 2 lakh per transaction. There is no transactions limit per day, but the amount you can transfer is up to your TPT limit (more on TPT in the next section of the article) and Max up to 50 lakhs.

Fees and Charges – There are no fees for the NEFT transactions, and the service is available 24×7 irrespective of the bank holiday.

What is HDFC bank transaction limit per day for RTGS?

High-value transactions from Rs. 2 Lakhs, and there is No Cap or upper limit. (up to your TPT limit)

Fees and Charges – RTGS transactions done online are free, and Rs. 15 if done through branch.

What is Third Party Transfer Limit (TPT)? How to set TPT to IMPS, NEFT, RTGS in HDFC?

In your HDFC account, you can easily set the transfer limit for a transfer mode like NEFT, IMPS, RTGS.

- Open HDFC net banking website on your computer – https://netbanking.hdfcbank.com/netbanking/

- Enter your HDFC Customer ID and Password(IPIN).

- Once you log in to your account, click on the “Funds Transfer” option from the main menu.

- Then click on the “Request” tab from the left-side menu and select “Modify TPT” Limit.

- To increase the limit, click on the “Increase” button.

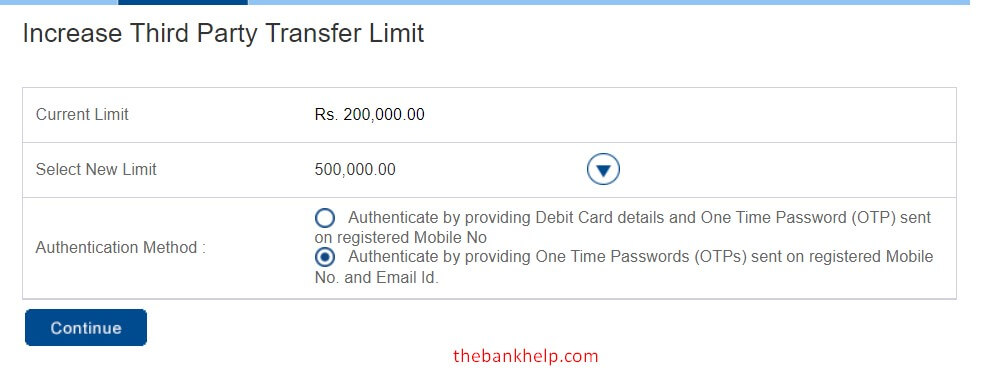

- Select the New Limit from the list. Also, select the verification method as Debit card details and OTP on registered mobile number OR OTP on both registered mobile number and Email ID.

- Confirm the new limit and click on Confirm button to proceed.

- Now, based on the authentication method you selected, enter the details asked for. For the first method, enter the OTP received on the mobile and enter your debit card number, expiry date, and CVV. For the second method, enter the OTP received on the registered mobile number and Email ID.

- Once the OTPs are validated, your new limit will be applied to third-party transactions.

Summary –

In this guide, we have seen the hdfc transfer limit per day for your HDFC bank account. If you have any queries/doubts regarding the information provided in this article, feel free to write to us in the comment section below.

I am new UPI new user, i transfer money per day 5000 of 10 transactions. I need 10000 for 2nd day transact . What to do? What is tha timings of fund transfer ?

this TPT limit change is not there in HDFC netbanking anymore.

Hi, for an amount of more than 2 lakh, you use the RTGS method. Also, for the first 25 hrs, you can only transfer 50,000 rs. Also, increase your TPT limit above 2 lakh by reading above guide.

I have registered Fund Transfer on 14.07.21 at 8-00PM and added a beneficiary at 9-00PM.

Now today 16.07.21 at 2-00PM why my fund transfer of Rs 250000 is refused?

Today at about 11-30am I have transferred Rs.1000/-.

Now I need to transfer another Rs.249000/- to the same beneficiary. What to do>